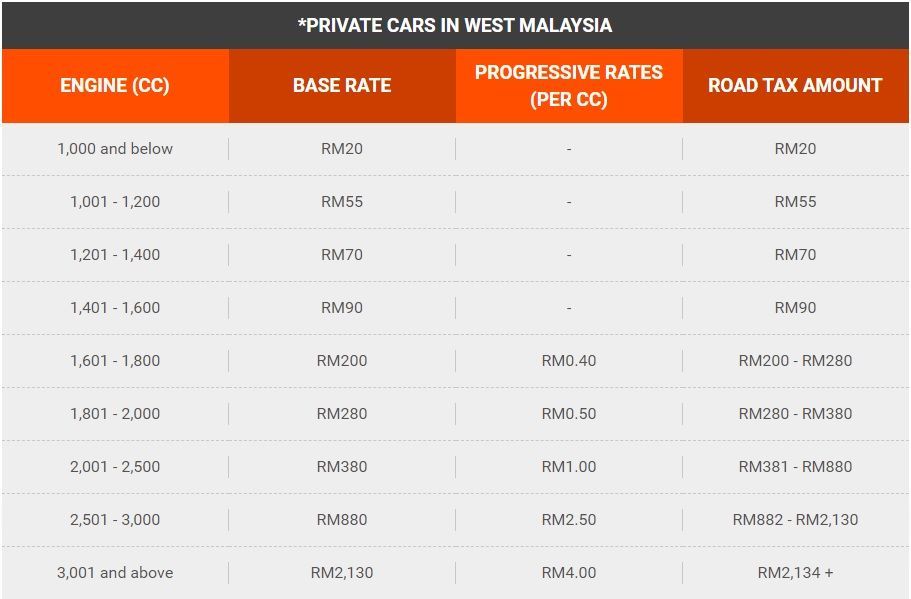

Above 75 kW the rate is calculated as per the following. Total of progressive rates Base Rate.

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link.

. Your road tax amount. The road tax on electric motorcycles in Malaysia is fixed at RM 2 for vehicles having an output rating of 75 kW. If you register your vehicle with the Road Transport Department they will charge this fee.

According to Malaysian laws all vehicle users have to pay a road tax. Sabah and Sarawak. So thats RM380 RM494 making up a total of RM874.

Most cars in Malaysia have less than 20-litre engine displacement. Base Rate Total of progressive rates. Total road tax.

So this puts your car into the 100kW 125kW bracket for the road tax. Amounts paid in road tax in this state are now. RM050 progressive rate x 200 RM100.

Engine Capacity cc. Road tax in Malaysia can be renewed both manually and online. Road Tax Calculator Latest JPJ formula - calculate how much your vehicles road tax will cost.

And that is how you can calculate the. When doing the renewal process manually you would have to purchase an insurance plan prior to renewing your road tax. On top of that RM1 is added on for each cc exceeding 2000 cc.

Road Tax for Private Car and Motorcycle. Latest JPJ formula - calculate how much your vehicles road tax will cost. Using the same formula if the engine capacity is 1599 cc it would be fixed.

RM7960 RM200. RM380 RM353. Above 80 kW to 90 kW RM165 and RM017 sen for.

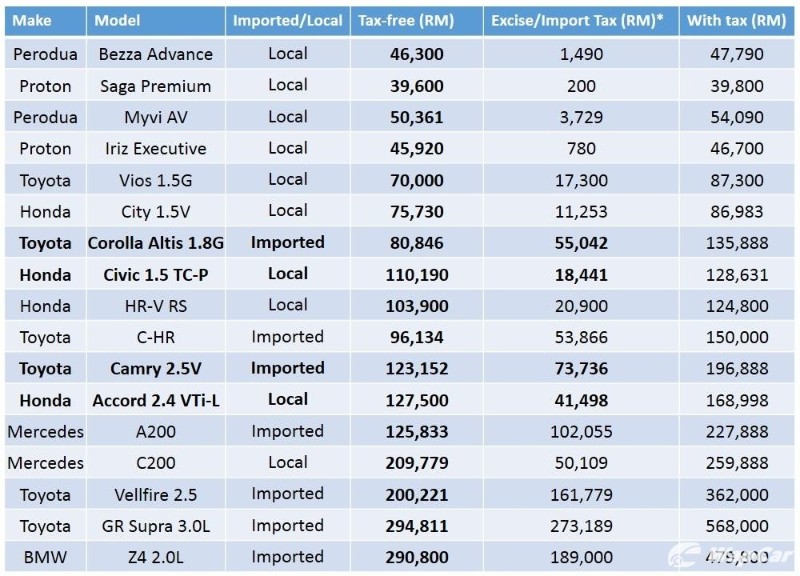

Price is valid for private cars only. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase. At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc.

Here the tiers base rate is RM380. Company Cars in West Malaysia Engine cc Base Rate Progressive Rates per cc 2001 - 2500 RM760 RM300 2501 - 3000 RM2260. As simple as it seems there are comprehensive tables to make reference to.

But generally the price is as below. Total Road Tax Amount. With an extensive database of new cars on sale in Malaysia.

The road tax for all four-wheelers is computed by taking into account the vehicles purchase price as well as other factors. Above 16L Cars that are above 16L or 1600cc will be charged to a maximum of RM200 per vehicle. NEW Road Tax rates for EVs in Malaysia.

Youll find prices specifications. RM274 base rate Remaining 10kW. So minus 1600cc instead of 1601cc.

Use otomy to reach over 2000000 car buyers on Malaysias 1. Progressive rate is capped at RM160 per cc only from 2500 cc onwards while a privately registered saloon car can be levied up to RM450 per cc from 3000 cc onwards.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Kadar Cukai Jalan Road Tax Dan Kalkulator Untuk Kiraan

Car Road Tax Calculator In Malaysia Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Malaysia Calculator Urijahct

How Much Do You Know About Malaysian Road Tax Ezauto My

Semak Harga Renew Roadtax Terkini Di Malaysia Bagi 2018 2019 Harga Roadtax Dan Insurans Honda Crv 20

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Do You Know How Your Road Tax Is Calculated

Do You Know How Your Road Tax Is Calculated

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

How Much Do You Know About Malaysian Road Tax Ezauto My

What Determines Roadtax Prices In Malaysia Bjak Malaysia